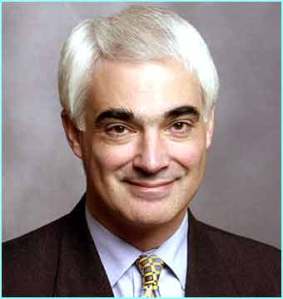

The Chancellor from the last Labour Government should be hailed as the man who saved the UK Banking system from financial collapse. Alistair Darling (MP for Edinburgh South West). He should be known for the fact that he was he who was solely responsible for actually avoiding a complete UK financial and banking meltdown.Even the telegraph has described him as a person who would be best suited as forerunner for the position of leader of the Labour Party in the past

The Chancellor from the last Labour Government should be hailed as the man who saved the UK Banking system from financial collapse. Alistair Darling (MP for Edinburgh South West). He should be known for the fact that he was he who was solely responsible for actually avoiding a complete UK financial and banking meltdown.Even the telegraph has described him as a person who would be best suited as forerunner for the position of leader of the Labour Party in the pastIt was he who took the decision to save the Royal Bank of Scotland, Halifax (HBOS), and Northern Rock and doing so also prevented virtually every other major bank in the UK from closing. At the time he is famously known as the bad guy who predicted that the world economy had reached the lowest point in a "60 year financial period" and said it may take decades - as his prediction is now proving - to recover.

In an interview in The Guardian published 30 August 2008, Alistair Darling warned, "The economic times we are facing... are arguably the worst they've been in 60 years. And I think it's going to be more profound and long-lasting than people thought." His warning led to confusion within the LabourGovernment who were oblivious to the problem - Darling, insisting it was his duty to be “straight” with people

Unlike US Government who took the decision not to help the major investment institution Lehman Brothers deal with their mounting toxic assets thus causing greater economic disaster worldwide - Alistair Darling avoided the UK going into a worse scenario in the UK - he took the decision without requiring legislation (as the US would require) to save Britain's major banks.

Below is an address he made to the London School of Economics which describes the actions he needed to take whilst in his position as chancellor when in 2008 the emerging European (including UK and Ireland) institutions started to feel the effects of the US financial market collapse.

[youtube=http://www.youtube.com/v/FaNjbqwjjIE?&w=300&h=250]

Related articles

- You: Fred Goodwin's knighthood: Alistair Darling leads the backlash (guardian.co.uk)

- The Chancellor and RBS: Osborne's failure to get a grip (telegraph.co.uk)

Comments